Indian Banks’ Loan Fraud Is Rs.61,000 Crore in Last 5 Years

Image Courtesy: Kashmir Monitor

Public sector banks have been weighed down by 8670 loan fraud cases in the past five years, amounting to a staggering Rs.61,260 crore according to RBI data obtained by news agency Reuters through RTI queries to banks.

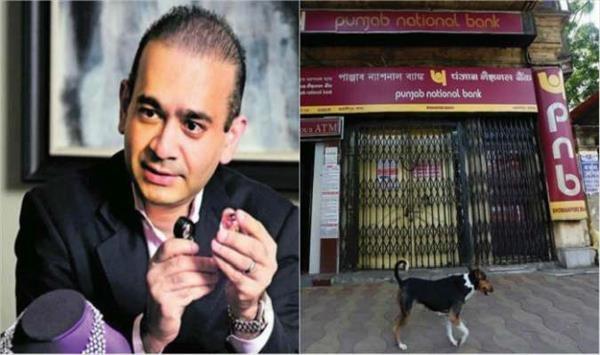

On 14 February, it was revealed that billionaire diamond merchant Nirav Modi had defrauded Punjab National Bank of Rs.11,500 crore.

These fresh revelations expose the way state run banking system has been systematically defrauded by rich and well connected borrowers.

The RTI queries were submitted to 20 of India’s 21 state-run banks and 15 of them replied. Data is for 2012-13 to 2016-17. The term ‘loan fraud’ refers to cases where the borrower intentionally tries to deceive the lending bank and does not repay the loan.

The actual number of bank fraud cases – and the amounts involved – could be higher because only cases involving loans of Rs.1 lakh or more are reported to RBI.

Bank loan frauds have steadily increased as well, reaching Rs.17,634 Crore rupees in the latest financial year from Rs.6357 crore in 2012-13, according to the data, which doesn’t include the PNB case, Reuters reported.

Although India’s central bank, the RBI, has not yet responded to the fresh revelations, it had flagged bank fraud as an “emerging risk” in its Financial Stability report published in June 2017.

“In a number of large value frauds, serious gaps in credit underwriting standards were evident,” the RBI said, adding that some of the gaps include lack of continuous monitoring of cash flows and cash profits, diversion of funds, double financing and general credit governance issues in banks, Reuters said.

PNB topped the list with 389 cases totalling Rs.6562 crore over the last five financial years, in terms of the total amounts involved, Reuters reported. After PNB, Bank of Baroda had the highest amount of loan fraud reported, with Rs.4473 crore from 389 cases and Bank of India ranked third, with loan frauds totalling Rs.4050 crore from 231 cases over the same period, the data shows. India’s biggest lender, State Bank of India reported 1,069 loan fraud cases in the last five financial years but did not disclose the amount.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.