Banking Sector NPAs - A Result of Neoliberal Myopia

Newsclick Image by Nitesh Kumar

After more than 2 years, NPAs of the banking sector, particularly those of the public sector banks – have become household news. As on March 31st of 2017, total NPAs of the banking sector stood at 9.6% of it’s total assets. If we also include those loans that are a breath way from becoming NPAs, then the number rises to 12% of the total banking sector’s assets.

The government and RBI have placed the blame for these bad loans squarely on the shoulders of the public sector banks (PSBs). After all, most of the NPAs are on books of the public sector banks.

Once the blame is placed, it is a short step from there to a prescription of privatization, of the public sector banks. This is what the RBI’s governor and other functionaries have been doing lately - advocating every other day, for privatization of selected PSBs. Government’s own draft Financial Resolution and Deposit Insurance (FRDI) bill, with it’s provisions for bank mergers and handing over of distressed banks to private entities, is widely seen as a step to towards public sector bank privatisation.

In this context, it is an important question to ask – is it the really the fault of the public sector banks that they have accumulated such large NPAs? Who really is the culprit here?

NPAs and the infrastructure sector

To answer this questions, let us begin by looking at the nature of the loans that have turned in to NPAs.

According to Credit Suisse, the bad loans are concentrated in particular sectors–infrastructure and construction (22%), utilities like power (14%), steel and other metals (17%) , and telecom (20%). Together these four sectors account for 73% of all the banking sector’s bad loans.

Clearly, there is something in the nature of these sectors, that may have caused the loans to turn bad. All these four sectors have two things in common.

One - all of them are all highly capital intensive sectors with long gestation periods before they become operational and start generating in revenue. For example, the gestation period for a steel plant or a thermal power plant can go up to 10 years or more. The long gestation period and large initial capital, also makes these sectors highly risky as investments.

Two - sectors like power and telecom are also in the nature of public goods. Irrespective of their ability to pay, citizens’ access to electricity and means of communication is indispensable – which makes these sector important from welfare perspective.

These are the reasons why, after India’s independence, these four sectors were developed under the public ownership. However, after 1990, under successive neoliberal governments of both congress and BJP, private sector was encouraged to enter to these sectors. Many public sector industries were privatised and those that were not privatized were deliberately weakened.

Financing private sector

Once in the domain of the private sector, financing infrastructure and other such project becomes tricky. The heavy fixed capital requirements of these projects mean that they need substantial financing over and above the capital brought in by the promoters. As a result, they look towards commercial banks for funds.

By nature, commercial banks are not equipped to lend to infrastructure projects. The infrastructure projects may take up to 10 or more years, before they generate any revenues. But, the liabilities of the banks i.e., their deposits on strength of which they lend, tend to be of much shorter maturities. This results in asset-liability mismatch. Even if the infrastructure projects are going to be successful, the banks can not wait that long to start receiving the interest payments and repayments of funds lent. This means that even a potentially successful project has a high probability of turning out to be an NPA, for a commercial bank.

This is one of the reasons why, after independence, separate long term financing institutions like IDBI, ICICI were set up for lending to infrastructure and industry. But, these institutions were stripped of their mandate and were turned in commercial banks. Today they do very little long term lending to infrastructure and industry.

Public Sector Banks to the rescue of private sector projects

Since 2004, when the then UPA government started pushing private players in infrastructure, power and telecom projects – the question was who was going to finance them?

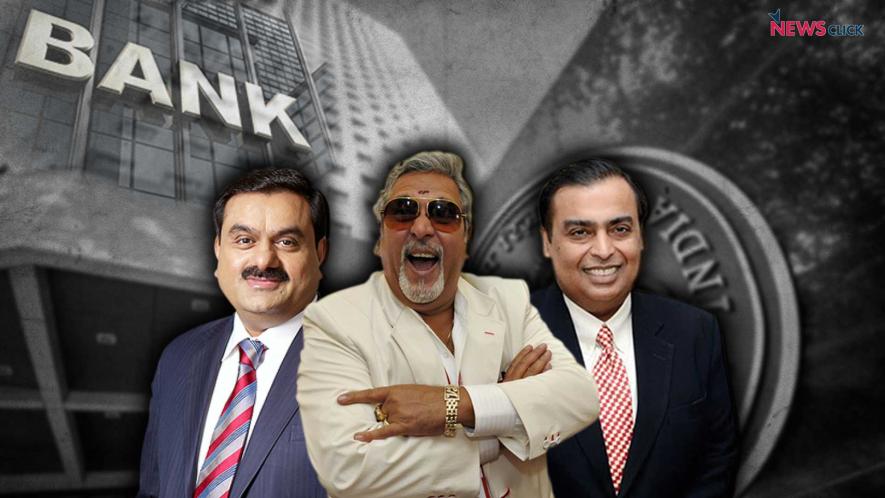

Private banks whose only motive was profitability, were unwilling to lend to these projects. As discussed before, for a commercial bank, these projects to risky. So, Government had come to the rescue of these private sector players among who are stalwarts like Adani and the Ambani brothers.

Both government and RBI, who today are blaming the public sector banks, compelled the PSBs to lend to these projects. RBI even relaxed many norms like exposure limits that bar banks from lending to individual companies and corporate groups beyond a certain amount. As a result, infrastructure lending grew at a compound annual rate of nearly 40%, reaching Rs. 9.8 lakh crore by March 2016.

It would not be an exaggeration to say that infrastructure investment financed by the public sector banks, was one of the important factors in India’s high economic growth over a decade.

While the government takes credit for the economic growth, the blame for NPAs is placed on the public sector banks.

Given the context, what were the options in front of the PSBs? They could have gone against government’s directions and refused to lend to infrastructure - thereby jeopardizing these projects that were supposed provide electricity, communications, roads etc., to ordinary citizens. Or, they could have lent to these projects, at the expense of their own balance sheets.

The public sector banks chose to do the later. In doing so, they were true to their mandate – which is public good, not just profitability.

The real culprit

The true culprit of mounting NPAs is not the public sector banks, but the neoliberal myopia afflicting the successive India governments, be it of congress or BJP. Their irresponsible drive towards privatization of everything in sight, including infrastructure sector, directly led to the present predicament.

One may ask - what is the connection between privatisation and NPAs? The rationale is straight forward.

Only public sector is best placed to handle the risks associated with ownership and handling of infrastructure projects. The private sector depends directly on the commercial viability of an infrastructure project for revenues, for profitability and for repayment of the loans. But, this not so, in the case of public sector undertakings. In the case of public sector projects, any lack profits from project itself, can be compensated by indirect generation of revenue to the government. The economic growth generated directly due to the infrastructure projects will increase revenues to the government.

Take the example of a power project undertaken by the government. It generates employment and growth, it helps the development and ancillary and related industry. This itself increases the government revenue through taxes and other revenues – compensating for the expenditure on the project fully or partially. While government may not recoup expenses of the infrastructure project directly, in can do so indirectly through increased revenues. This way government can quickly repay any loans it has taken from the banks for financing of the projects – instead of waiting for a decade until the project starts generating profits.

As a result, it is less risky of the banks to finance public sector infrastructure projects than private sector infrastructure projects. Government’s presence, in different economic spheres and diversity in it’s revenue sources, places it in a better place to repay interest on infrastructure loans. Where as in the case of a private project, the corporate group, even if it has diverse interests, does not take the entire responsibility for the loans of a single entity in its group.

For example, a particular company in the Adani or Ambani group of companies may default on the loan. But, due to the way law works, it is difficult for the to banks compel the parent group to pay back the loan, even if the group as a whole is making profits.

The unwanted solution

The solution is clear to those, who are looking for one. Government needs to take back the control of industries that are crucial for public welfare. Let government nationalise the infrastructure projects, that are crucial for public welfare. This way projects have a chance of seeing the sunlight. And, their loans which now are classified as NPAs, can be converted to longer term loans. After all, government debt carries very little credit risk to the banks.

The real problem is not the lack of a solution, but a government at the center which does not really want a solution. What government really wants to do, is to hand over the ownership of the PSBs to private players, in the pretext of dealing with the NPAs. With the total privatisation of banking sector, Modi government intends to complete the neo-liberal project that the congress government started in 1991.

Disclaimer: The views expressed here are the author's personal views, and do not necessarily represent the views of Newsclick.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.