A Nation in Agony: Demonetisation – Is it Worth the Trouble? Part 1

Question: The Prime Minister said the problem will be over in 50 days. Now the Finance Minster has stated that it will take 3 – 6 months. The RBI Governor does not give a time line. As a banker and association please let us know how long it will take for the problem to end?

Franco: It is unfortunate that nobody knows or nobody tells exactly when this problem will be over. When the PM & FM give contradictory statement, it is difficult to decide which is going to be correct. But from what has happened in the last 43 days, the position is bad. Even now banks are rationing cash, many ATMs are empty and the queue continues. As per the detailed report published in Frontline dated 9th December 2016 and articles published by Business Standard as a four part series, the RBI does not have adequate capacity to print 46.93 billion new notes which are required within 1 year. So the currency shortage is going to continue for long.

Where the currency is printed? Was the RBI not aware of its capability?

Franco: Currency notes are printed at Bharath Reserve Bank note Mudran Private Ltd, Mysuru and Salboni (West Bengal) Both these are under the control of Reserve Bank of India. Security printing and mining corporation of India Ltd has two units one at Nashik in Maharashtra and the other at Dewas in Madhyapradesh. These two are controlled by the Finance Ministry. As per reports, printing of 2000 notes has been temporarily stopped and 500 notes are being printed. We badly need 100 Rupee Note also. All the printing presses are working overtime in shifts but they have not been able to print enough.

In his own statement RBI says that out of 14.6 lakh crores 13 lakh crores of currency has come back to the banks and RBI has dispersed around 4.5 lakh crores. There will be more deposits by December 30. So there is necessity for supplying around 11 Lakh crores more to bring back normalcy. RBI printing presses are not capable of doing this within 3 months. May be RBI wants to force people into a less cash economy by switching over to transactions without currency.

Is it not good to switch over to a less cash economy?

Yes. It will be good but moving over to a less cash economy is not that easy.

For example in the much talked about point of sale (POS) machine you have to key in your pin number. You have to carefully see whether the amount has been keyed in correctly by the shop keeper or the vendor. Majority of our people find it difficult. In mobile banking the person who is paying and the person who is accepting money have to know their account numbers and the procedure for completing a transaction in which again passwords have to be correctly used. There are chances of cheating. Even e-wallet frauds have come to surface.

Moreover before announcing demonetization steps should have been taken. For example now the Govt has announced that there will be two POS machines in one lakh villages. They have also projected that by March 2017 there will be 10 lakh POS machines added. This should have been done before demonetization. Nobody would have questioned why you are introducing more POS machines or more ATMs.

The only country which has switched over to a cashless economy is Sweden where 100% of the people are literate, education is provided free by the Govt and every citizen has an internet connection. . A question also arises whether these things can be forced on the people when the Govt has not provided free education, free health care and free connectivity to all the citizens.

You had stated that private banks were given more money than the public sector banks.

Yes, I had stated that private sector banks like ICICI, Axis Bank and HDFC which have much lesser number of currency chests and less number of branches were proportionately given more fresh currency than the public sector banks together. This has been reported in different parts of the country. Hence it needs investigation and clarification from the Reserve Bank of India.

When the RBI has stated that adequate currency is available why banks are not paying Rs.24,000/- per individual per week?

This is one of the reasons for which I demanded that the RBI Governor should quit. The reality is there is shortage of currency. Banks have not been provided adequate currency. Because of this Banks have to ration what is available so that more people get some money. The Bankers have been working overtime to service as many customers as possible without adequate sleep and rest. If there is currency why they will not give? In Tamilnadu we have been collecting currency from shops including TASMAC shops so that we could disperse as much cash as possible. The statement of RBI misleads public and public start fighting with the Bankers. This should come to an end.

Don’ you feel that people have been made to beg for their own money?

Yes, there are begging at different levels. Public Sector Banks are begging RBI to provide adequate currency to their currency chests. Some banks are begging to the currency chest owning banks. Even within the banks, branches which do not have currency chests are begging to the currency chest branches. The customers are begging to the bankers to provide adequate currency.

Your Chairman has stated on November 14th that within 10 days things will become normal. Why it has not happened so?

May be even the SBI chairman was not given the real picture by the Finance Ministry or Reserve Bank of India. The problem is supply of currency. SBI cannot print its own currency and it has to depend on RBI.

What are the constraints for the Banks?

There is too much of burden on the banks. The first is the shortage of currency which has made bankers work day and night for arranging currency, loading ATMs and convincing the customers to take less cash.

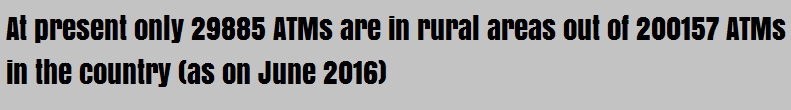

Only for one day the ATMs were shut down. Probably RBI did not know that there is requirement of recalibration of ATMs to load Rs.2000 notes as the size of the currency had been changed. Adequate Rs.100 was not available. So the ATMs are still getting calibrated and as per news reports even the recalibrated ATMs only 36% of them are functioning due to shortage of currency. The joint custodians had to come even on holidays to give cash to the ATM outsourced Agencies for loading ATMs. This has put lot of stress and strain on the Bankers.

Then suddenly we were asked to use indelible ink which was not available in the market. It took 5 days for us to get the ink. One fine day it was announced that for marriage purpose one could withdraw 2.5 lakhs and 5 lakhs for both the couple together. People started coming with invitation cards to get payments. We started paying. After 3 days the circulars came from RBI with so many conditions, it is impossible to fulfil all the conditions and pay the couple. Now that is also changed.

Initially the Business Correspondents who are around 250,000 in number were not allowed to pay cash. This put tremendous pressure on the bankers. Again adequate cash was not provided to post offices which have a large network of 1.55 lakh branches. As per the Hindu dated 10.12.2016, only Rs.238 Crores has been given to post offices till 9th December 2016.

Another big problem is the Co-operative banks which have 93,042 Primary agricultural co-operative societies under 370 district co-operative banks supervised by NABARD were not provided cash for exchange. It is stated that they had Rs.3.5 lakh crores with them. Their outreach is 15 crore customers. If they would have been permitted to exchange currency and provided cash the situation would have been much better. It is said that providing currency to co-operative banks would have led to massive exchange by politicians. It is not so. By providing strict norms and monitoring the transactions later, misuse could have been detected as it is being done at Mumbai now. After all without any limit, new generation private sector banks have been given so much currency and now it has been proved that they have done lot of exchange illegally. The poor co operative banks are suffering when the customers are left in the lurch. Till now no body knows when they will be able to give back the old currency notes which they are holding and get fresh currency. When Big Bazaar could accept old notes why not the Co-op Banks?

Another problem was handling old soiled notes given by RBI in Rs. 100 and smaller denominations. They had fungus, they were stinking and the cashiers and officers had to use masks and many of them fell sick .

The biggest problem is the other banking business has come to a grinding halt. No NPA followup, almost nil sanction of new loans, and the advances portfolio has gone down by more than 65000 crores. This is going to affect the profitability.

One more burden thrust upon the Bankers was to deposit 100 % of the incremental deposits as cash reserve with RBI which was not earning any interest. This has increased the burden.

Another burden is the cost of recalibrating ATMs, cost of putting up shamianas and Pandals in places where it was possible, providing tea where possible and the expenditure on overtime and out of pocket expenses for late sitting and working on holidays which is going to again affect the profitability of the banks.

One another burden is lack of space for keeping the old currency. At many places they are kept on the floor with huge risk. When we return this to RBI there might be problems of shortage( due to the counting machines which will not be able to count the old notes correctly as some of them will be stuck together)

A sudden announcement of permitting the borrowers to defer their loan repayment by 2 months is also going to be a big burden on the banks where already the NPA is mounting and the Govt has not taken any steps to implement the parliament standing committee recommendations.

There is going to be further burden for returning these old notes to reserve bank, increasing the advances and follow up of NPA.

The Finance Ministry has announced that 27 public sector bank officers have been suspended. Is there large scale mis use of the Banks system and procedure?

First of all I demand that the Finance Ministry publishes the names of officers suspended as on that date. As per our information it was just 10 officers and 11 cashiers. Out of 1.32 lakh branches with more than 3 lakh officers and 7 lakh employees 10-20 black sheep should not have been shown as big, and painting a bad picture of bankers. This was probably to divert attention from the anger which is building up against the Finance Ministry and the RBI. It is unfortunate that the Finance Ministry never spoke about 17 Bank employees who have died during this period in work related to demonetisation and the number of employees who have fallen sick due to this hard work. As because one former Minister of BJP, one youth leader of BJP and an MP’s son in law in Nagaland connected to BJP have been caught, can we say entire BJP leadership is corrupt? As few RBI Staff are arrested, can we say entire RBI is corrupt?

The system is perfect. Anybody who misuses will be caught sooner or later. Serious actions are always taken against the culprits. In most of the cases it was the bank management which had seen the mistake and suspended the people. The Banks have a very strict service condition and those who commit mistakes are never spared. Already special Audits are going on.

It is these bankers who made jan dhan yojana a success and it is these bankers who are toiling day and night. Rumours are that the Government is looking for scape goats and bank officers will be the target.

What does the All India Bank Officers’ Confederation Demand?

From Reserve Bank of India we demand that the RBI should supply adequate fresh currency in Rs.2,000, Rs.500 and Rs.100 denominations immediately.

We also demand that RBI should publish full data on Rs.2,000 and Rs.500 printed from the first day of printing. The details should have the date of printing, date of despatch, where it was despatched, how much was the despatch, what were the numbers printed in the currency and to which state it went? RBI should also give state-wise details of notes distributed to different banks from day 1, indicating the amount, denomination and value including non issuable notes (separately).

Appointment of officer directors

From the Govt we demand that the Govt which talks about transparency and good governance should immediately release the appointment of Officer Directors and Employee Directors. More than 20 recommendations are pending and some of them for more than 20 months. This will give some transparency to the Banks Boards which take major decisions regarding sanctioning large loans, write off of loans, and also deal with the HR matters of Banks.

We also demand that the recommendations of Parliament Standing Committee on NPAs should be implemented immediately. We also demand that the expenditure involved in the demonetization exercise by the Banks should be reimbursed by the Govt to the Banks.

We also demand that the families of Officers and employees who died during the period starting from Nov 8th should be provided compassionate appointment.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.