Kerala Budget 2018-19: How the Left is Forging an Alternative

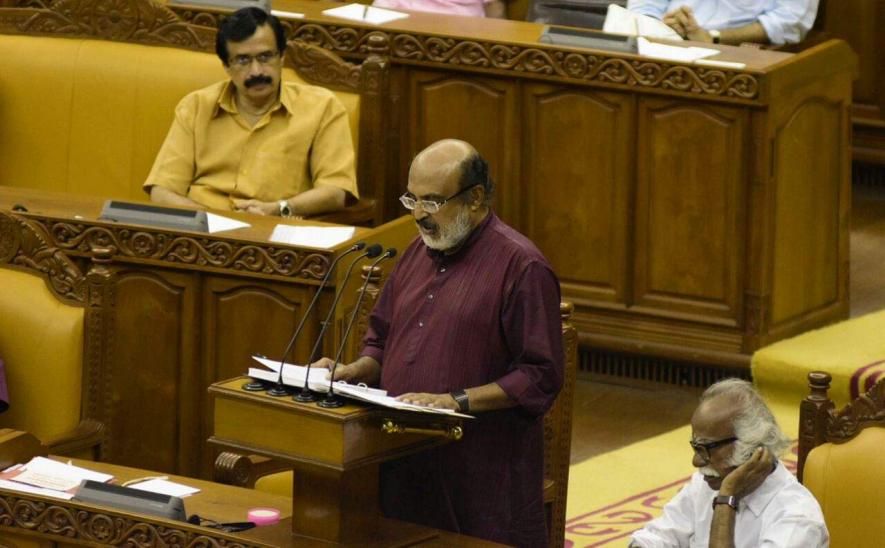

A day after Mr. Arun Jaitley presented the Union Budget, Kerala’s Finance Dr. TM Thomas Issac presented the State Budget. The Budget must be understood beyond numbers and statistics as a political document that reveals the vision of the party in power. Thus, it is important to contextualise the State Budget as a representation of the Left Democratic Front’s alternative to the neoliberal policies pursued at the national level. While the Union Budget has been wrapped in the rhetoric of seemingly pro-poor policies with an eye on the upcoming election, the Left government in Kerala has charted an alternative through its consistent commitment to social justice. Such a public commitment to welfare is remarkably ambitious given that the state is fiscally constrained due to multiple reasons.

Fiscal constraints

The LDF government which came to power in May 2016 released a White Paper on State Finances the very next month that outlined the state of the economy. There were two important points that the document highlighted: inefficiency in tax administration and the increasing Non-Plan Revenue Expenditure (NPRE) component. Growth in tax collections declined in 2011-16 (the term of the previous government led by UDF) due to improper governance. While capital expenditure (capex) did not grow adequately, revenue expenditure went up – of which Salaries, Interest and Pensions (SIP) played a major role. But apart from these committed liabilities, the NPRE minus SIP component increased which was avoidable. Schemes were announced with no means to finance them. Such was the state of the Kerala economy when the present government took over. The White Paper highlighted the urgent need to bring down NRPE, and moderate the SIP component. Moreover, the general trend of nationalisation in the Middle East has spelled trouble for the economy in which remittances play a significant role.

The problems in the domestic economy were further aggravated due to certain knee-jerk policies followed by the Center. While the mindless act of demonetisation cast its shadow over the state in the previous year by bringing the cooperative sector and the small-scale industries to a standstill, the shoddy implementation of GST affected state finances this fiscal year. The GST that is a destination tax was expected to benefit a consumer state like Kerala with tax collections expected to grow by more than 20 per cent per cent, according to the Economic Review 2017. But, even after compensation, the growth in tax collections only amounted to 14 per cent. Kerala meets 75 per cent of its needs from inter-state trade, which means revenue collections from IGST must be at least one fold higher than SGST – which was not the case. This again points towards the leakages in the system. Rs. 1 lakh crore that was due to the Center and the State has not been disbursed post-GST. The GST regime has curtailed any element of autonomy in taxation powers that the states had, thereby fiscally cornering the states. But once the initial glitches are resolved, it is logical to presume that the state will gain in indirect tax revenues. It is hoped that the tax-GDP ratio will improve once this sets in.

The government’s aim to moderate the revenue expenditure may not be adequate to divert resources for the much-needed capex due to the fiscal deficit target of 3 per cent. Two points need to be kept in mind: Kerala’s state’s capex is very low when compared to other states. Moreover, with the stringency in relation to fiscal conservatism that is exercised by the centre, it is clear that the State has little room to spend beyond the stipulated deficit targets. This has led the State to pin its hopes on the Kerala Infrastructure Investment Fund Board (KIIFB).

KIIFB – the way out?

KIIFB that has been termed a “financial innovation” by Dr. Issac is not new – it has existed since 1999. But the credit goes to the present government for the reconceptualization of KIIFB as the primary driver of Kerala’s next phase of development. KIIFB will serve as a Special Purpose Vehicle to securitise future income flows. The idea is very simple – Kerala needs to increase its capital expenditure, but the fiscal situation ties its hand from spending as much as it needs to. If the conventional route was followed, an entire generation misses out while the costs go up. So, without curtailing other essential expenditure, the state capitalises on two income flows that will continue in the future – the motor vehicle tax, and the cess on petroleum. KIIFB mobilises resources from NRI investors (through chit funds) and bond markets (General Obligation Bond, Revenue Bond and Land Bond) and implements projects in a time-bound manner. “Assuming 9% interest, three years moratorium and 7 years repayment period, a total of Rs.1 lakh crore will have to be repaid”, says Dr. Issac. Since there is an assured income flow and a cap on this borrowing, there need not be any unnecessary worry regarding debt imposition on the future generation. The government has roped in experts like former CAG Vinod Rai to oversee the operations of KIIFB. Thus, what would have taken over two decades in the conventional budgetary route, can be done in five years through KIIFB.

The “innovation” here lies in the fact that the borrowing via KIIFB is off-budget. Hence, despite fiscal consolidation, Kerala can pursue its goals of social and capital expenditure. This commitment to what the Left stands for despite the neoliberal onslaught is what the State Budget is all about. That being said, it is also to be remembered that investment from private capital depends on expectations of profit and the success of KIIFB depends on the ability to mobilise the necessary resources. The ambitious attempt to preserve the progressive tradition while working within the constraints imposed by a capitalist national economy is to be seen as the Left’s pragmatism and not its irrelevance. As State Planning Board member Dr. K. Ravi Raman says, “the political sovereignty that was lost by GST is regained by the government through KIIFB – in a dialectical fashion.”

Kerala Model 2.0?

The Budget unveils a comprehensive social security programme that covers all aspects like housing, food, education, health, and welfare pensions. Rather than diluting the public sector, the state government recognises the deficiencies that exist and attempts to revamp it. While disinvestment and privatisation has been the neoliberal norm, the Left in Kerala stands apart by infusing capital and modernising the PSUs through specific action plans. This has helped the PSUs to register a revival, as the half-yearly report from the Department of Industries and Commerce shows. The Kerala model that is famed for high indices of human development despite low per capita incomes is at a crossroads. The state acknowledges this and focuses on the “second-generation challenges” (for example, in health) faced by the people. While the health insurance programme of the centre is welcomed, the fact that it is not a substitute for public healthcare is acknowledged. Thus, the Budget intends to strengthen the government’s commitment to the chain of PHCs in the state. The Ardram mission envisages locally available preventive care through early intervention by the PHCs in the case of lifestyle diseases. The ASHA workers, who have been consistently ignored by the centre, will receive more monthly allowance of Rs. 2000 each.

Public schools are given a thrust as private education is becoming increasingly unaffordable. However, more needs to be done with respect to the higher education sector in Kerala. The marginalisation of women, transgenders, fisherfolk, and SC/STs has been recognised as a major shortcoming of Kerala’s development trajectory. The Minister’s Budget speech that was peppered with references to women writers openly condemned the male chauvinism that is prevalent in Kerala. The Budget unveils comprehensive measures for the women in Kerala from increasing workforce participation to awareness programmes on gender violence. There was also a reference to the unpaid and unseen work done by women and it is hoped that this will be dealt with in the years to come. The transgender policy is a step forward with an assurance of safe and secure homes for them. There are substantial schemes for the rejuvenation of Kerala’s coastal areas devastated by cyclone Ockhi. In an age of intolerance and caste violence, much needs to be done with respect to the welfare of marginalised castes and tribes. It is hoped that the government will push its progressive agenda forward to include the hitherto excluded. The ambitious programmes have to be implemented properly with minimal exclusion, so that the Kerala can still remain an alternative model of development.

[The author is an MA student at the Department of Economics, University of Kerala.]

Disclaimer: The views expressed here are the author's personal views, and do not necessarily represent the views of Newsclick.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.