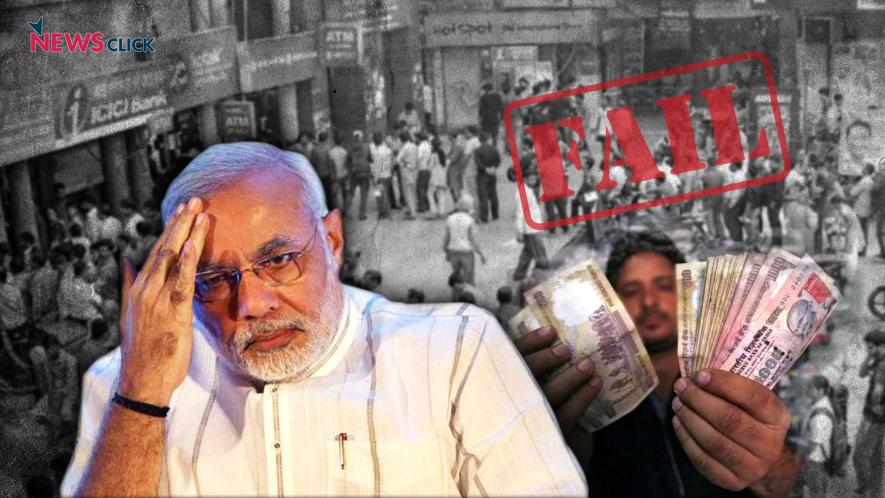

Demonetisation Failed: The Emperor is Naked

Newsclick Image by Nitesh Kumar

After eight months of prevarication, the RBI in its latest Annual Report has come out with the value of the demonetised notes that have been returned to it. Notes worth Rs. 15.28 trillion – 99% of the demonetised currency worth Rs. 15.44 trillion – has come back to the central bank. This 15.28 trillion does not include the old currency deposited in District Central Cooperative Banks between November 10th and 14th, or the old currency that is still to be received from Nepalese citizens and financial institutions. Once these are accounted for, it would not be a surprise if 100% of the old currency is back.

By all accounts, the costs of demonetisation have been high. For Rs. 16,000 crore money that has not come back to the bank (yet) – which may or may not be black money – the RBI has spent Rs. 21,000 crore in printing the new notes. This is in addition to the costs that the banking sector incurred in the process of exchanging old notes etc.

The Annual Report accepts that demonetisation has had a negative impact on economic growth, particularly on the sectors that are more dependent on cash transactions. The report also says that industrial growth and output have gone down due to demonetisation, seriously impacting the economy as a whole.

One of the justifications given by the government in support of the measure was that demonetisation would increase the deposits with banks, which will, in turn, lead to more bank credit to the economy. What actually happened was the opposite. The report says that due to the banks’ and their employees’ “preoccupation with the exchange of old currency”, bank credit had taken a hit. It seems the credit growth for 2016-17 is the lowest in two decades. The lack of credit dealt a serious blow to the informal sector, which was already reeling under the effects of lack of cash.

While the claims on black money returning to the government have been rubbished by the data, the Finance Minister now claims that the real objective of demonetisation was not really the confiscation of black money. He said that the note ban resulted in an increased tax base, increased digitisation and squeezed terror funding. None of these claims is supported by facts.

It has been pointed out by many economists that the growth of the tax base for 2016-17 is in keeping with the growth of previous years and there has been no spectacular rise. The modest increase in electronic payments proved to be temporary. Once the cash came back to the economy, people shifted away from electronic transactions. A quick calculation based on RBI’s data shows that overall electronic transactions have declined from Rs. 1390 thousand crores in March 2016 to Rs. 1375 thousand crores in June 2017. Similarly, retail electronic transactions including the usage of Point of Sale machines have declined from Rs. 185 thousand crores to Rs. 165 thousand crores in the same period. Clearly, Indians don’t want to be arm-twisted into giving up cash transactions.

On the issue of terror funding, the less said, the better. The government claimed that large scale printing of fake currency in Pakistan is the reason for terrorism. Demonetisation was supposed to weed out fake currency, thereby putting a check to terrorism. As it turns out, according to the RBI, out of the total of Rs. 15.44 lakh crore demonetised currency, only Rs. 41 crore or 0.002% was detected to be counterfeit. One wonders at the frugality of terrorists that they can finance their dastardly activities at a cost of 41 crore rupees a year.

Clearly, terrorism doesn't thrive on fake currency alone, as evidenced by the attacks on the Amarnath pilgrims and various other attacks on armed and police forces in the 8 months after the note ban was announced.

Besides all these, the RBI’s Annual Report points to some very worrying facts about the economy. It points out that the economic growth rate for the year 2016-17 was saved by the large increase in government expenditure in the form of the Seventh Pay Commission. Such a spike in public expenditure is absent in 2017-18, which will push down the already lagging growth. According to the report, business confidence in the economy has waned, investment has slowed and the prognosis for future economic growth is bleak.

Ironically, after expressing doubts about economic growth, the RBI lauds the government for successfully sticking to the fiscal deficit target of 3.5%. Clearly, the eminent economists at the central bank and the government are not aware that capping of public expenditure at this point will simply make the situation worse.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.