Union Budget 2014-15: Continuity Without Change

Newsclick speaks to Prof. Surajit Mazumdar from the Jawaharlal Nehru University on the Budget 2014-15. Mazumdar says that the remarkable feature of this budget is that the numbers presented in this budget and those presented in the interim budget are practically identical. There is very little difference between these two budgets. He says the policy of fiscal consolidation, whose hallmark has been expenditure compression in the face of falling revenues, has placed enormous burdens primarily on heads like agriculture, rural development, subsidies, social services etc. Mazumdar underlines that the kind of growth we are seeing is exclusionary in distribution and feels that the slow down is a direct result of the kind of growth trajectory that is being pursued.

Prabir Purkayasta (PP): Hello and welcome to Newsclick. We have with us Prof. Surajit Mazumdar from Jawaharlal Nehru University.

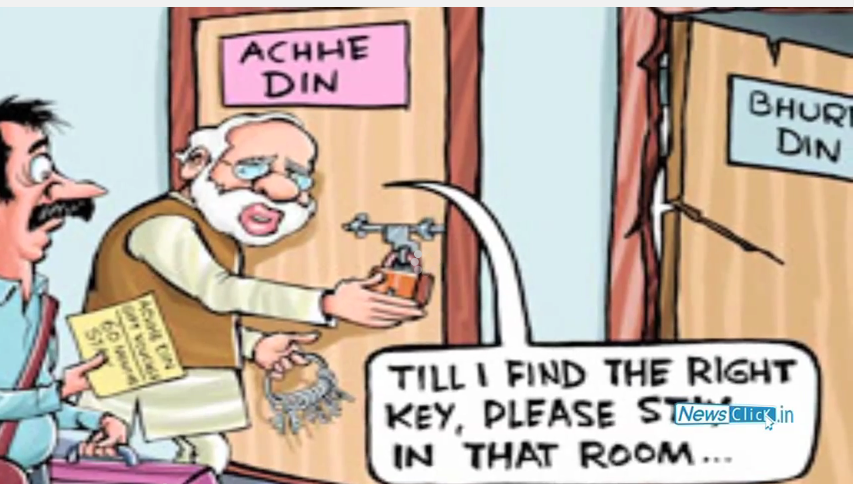

Surajit what appears to be happening with the budget issue is that we had a Chidambaram budget really replaced by Jaitley budget but not substantively different. What Swami Iyer called Chidambaram budget with the saffron lipstick.

Surajit Mazumdar (SM): Well, actually one of the remarkable features of this budget is actually the fact that the numbers in this budget and those in the interim budget which was presented in February by P Chidambaram are practically identical. There is very little that is different in these two budgets and the fact that the outgoing government on its last legs, when it presents an interim budget in which actually nothing new is supposed to happen, that is exactly, more or less the same that the new government presents and that indicates something and in my view it indicates two things.

The first is that the most obvious thing is that the policy of fiscal consolidation which has been pursued for the last few years, whose hallmark has been expenditure compression in the face of revenues falling short, where the burden has been placed primarily on heads like agriculture, rural development, subsidies, social services, of this expenditure cut; so expenditure compression in the face of lagging revenues – continuation of that policy is the first thing that is indicated.

PP: Basically the social service expenditure has been cut in order to match the revenue in that sense.

SS: Yes, that’s the broad thing. The second thing that is indicated by this is, and that’s got to do with the absence of a significant change from the past and that is that, that particular approach of the fiscal consolidation in present economic and political conditions has actually perhaps reached its limits because the expenditure compression policy itself has a self limiting nature. You cut back expenditures in an economy which is already facing a slow down. It doesn’t boost the economy and of course it doesn’t address the long term constraints that are behind the slow down. The effect of that on the revenue side is adverse and then they try and keep the fiscal deficit down to keep curbing the expenditure and that reaches the limit beyond which it’s difficult to push and I think that’s the kind of limit that has been reached by this policy and it’s a kind of dead end and therefore the danger that is there is that if this approach is pursued then very quickly, given the fact that there is a great possibility of rise in oil prices, there is already a problem about the rain. Given these conditions and these threats that are already there, the government may soon be faced with a very sharp choice between either giving or administering a very bitter pill to the people of this country through further compression of expenditure or living with a higher fiscal deficit I don’t think they they can avoid that choice.

PP: Coming back to what you said, compression of expenditure. There are two parts to it. One is of course the budget itself you do not address what you need to address. The fact that there is lack of employment, health facilities; one of the most privatized health care systems today is in India. Access to education is limited, employment generation is very very low. This is one part of it. The second part of it is over-estimation always in the budgets of saying the revenue will be so much and of course the revenue is not so much and then hidden later on in the year's consolidation of revenue presented for the next year, you see a further cut in the expenditure even that is projected in the budget. The second is quite often hidden. So do you think that these two things are both present in the current budget?

SM: Yes actually in the last two budgets we have seen this that actually revenues have fallen and have been less than what was anticipated and in response to that expenditures were also cut so as to still keep fixed to the fiscal deficit target. So what was budgeted actual expenditures are actually even less than that. That has happened for two successive years. This particular year also, the revenue anticipation appears to be, by fairly universal agreement, overtly optimistic, given that actually no particular measure has been taken to enhance the revenues. So the projections as far as the revenues are concerned which were there in the interim also, everyone agreed that the in the interim budget’s projections were optimistic and it appears to be the case this year too, it is an optimistic estimate and if then revenues fall short and you have the tendency to keep expenditures down again then the expenditures already low, may actually face further cut and actually if anyone sees that despite lot of rhetoric about huge amounts of expenditures and popular schemes and subsidies and things like that, actually if one gets down to numbers, it’s quite clear that the principal burden of fiscal compression actually has been faced by precisely those heads that are highlighted in any discussion about the so called populism and they have already been compressed. If one sees actually in proportion to GDP, they have been coming down for five years, if you look at it in real terms adjusted for price increases, they have actually been stagnant for five years, many of these expenditures. So any further compression of that can only have extremely severe consequences for the people of this country.

PP: “Compression”, what you are talking of is basically “cuts” and NREGA cuts being one of them this time.

SM: Yes, the allocation for NREGA this time is 34,000 crores, which is practically the same as last year, which means in real terms less because prices have gone up , minimum wages should adjust and last year was relatively a good agricultural year, this year you are anticipating a bad agricultural year. So actually the demand for NREGA employment should be higher this year and this 34,000 crore is actually less than what was spent 3-4 years ago. So actually the NREGA allocations have also come down.

PP: And it contains wage which is not been given, so its even worse.

The other part of it is the revenue story. This is the expenditure part then there is a revenue story. The revenue story is that India today, tax to GDP ratio is one of the worst in the world in the sense that its really low tax in terms of what is the GDP. Even those countries which are supposedly the Mecca of capitalism like US and all have better tax to GDP ratio. Any indication that's going to change or is it that there is a statement to that account, you know that we couls improve our tax to GDP ratio. Any indication or is it worse?

SM: Absolutely not. In fact in the world over there is a debate in society, amongst economists on this whole question of austerity but the Indian situation I think should be treated somewhat differently even within the context of that debate because it is a country in which both the tax as well as the expenditure to GDP ratios are amongst the lowest in the world so clearly the long term trend has to be, for both to increase. What we are seeing is the exact opposite - the tax to GDP ratio is lower than it was in 2007-8. Its about 2 percentage points lower than that. So in the last 5 years what you have seen is a regressive movement as far as tax in concerned rather than progress. Even in this particular budget, tax concession has been given as far as direct taxes are concerned. For some segments at the lower end of the income paying spectrum, there might be a case for some concession being given but for a large number of extremely rich tax payers there has been nothing done in terms of taxing them more to compensate whatever revenue loss these concessions will bring about. So you have given some concessions which lead to revenue loss and you have actually shifted somewhat the tax burden a little bit more onto the indirect taxes, which are taxes whose burden falls on actually everyone whereas the direct taxes fall upon a relatively prosperous, so that itself is a regressive movement. So what you should be actually moving towards is a higher tax to GDP ratio in which the proportion of direct taxes increases. What we are getting is the exact opposite movement and then you say that the fiscal deficit has to be kept in check and therefore some or the other expenditure heads have to suffer as a result of this. So instead of actually pursuing an approach where you try and generate more revenues, which allows you the space to spend more, you are getting an opposite movement. So the so called absence of fiscal space that the finance minister referred to and others referred to, that absence of fiscal spaces, in some senses are self created. It’s not a constraint that is given, it’s a constraint that is created by an approach where you rely more on tax concessions and expenditure cuts rather than on generating taxes and spending.

PP: Of course, a general issue is, should there be a sacrosanct fiscal deficit limit, that we are not getting into because that’s something we have discussed in Newsclick enough and that is a bogus economic theory. If you provide for investments which pay back then the fiscal deficit that you are talking about is an artificial limit but without getting into it, that part of the philosophy is constant between both the governments like you are saying NDA and UPA and what you are saying is rest of the policies are roughly the same. Coming back to what ails Indian economy, essentially we see both stagnation and inflation particularly in food prices, more than 10% per annum inflation consistently which hit the poor much more. Any change in the kind of policy they are pursuing, which are being indicated in the budget?

SM: No absolutely not. I think the fundamental constraints on as far as the Indian economy is concerned is that even when you do get growth that growth process is so exclusionary in nature its benefits are so concentrated that, that particular pattern of distribution of its benefits itself acts as a barrier to its sustenance. So the growth slowdown is not an incidental or exogenously created problem. The growth slowdown is in fact a direct result of the same policy which produced the 8-9% growth. The transition from the 8-9% growth to the slow growth was inbuilt into that very growth trajectory itself.

PP: Which is what you said in the beginning, that essentially we are now hitting the brick wall?

SM: In fact, every problem that you can think of whether it’s the growth slowdown, the employment problem, the inflation problem particularly food prices, even our current account problem, large amount of gold import etc., all of them have a very close relationship with the pattern of distribution of the benefits of growth. As long as you stick to that trajectory, that particular problem will remain. Now the budget becomes important in that context because fiscal policy is something that is important in changing that particular trajectory because you take away money from some areas, some kinds of expenditures and put it elsewhere so it can act as a mechanism of redistributing the benefits of growth and in turn, then also changing the nature of the growth process and what is it based on. A growth process is based on accumulation, accumulation, accumulation at the top of the economy of the Indian society is inherently going to face these kinds of constraints and there is, in this budgetary exercise, no recognition of the fact that there is actually this fundamental problem. So fiscal consolidation in such times reflects in my view a fundamental committement in maintaining that particular growth trajectory which itself has created this problem.

PP: Basically what you are saying is creating wealth for the rich can only provide certain degree of developmental growth and so on, but in the long run its not sustainable unless you are able to pull out large numbers of Indian people from the poverty they are in and therefore sustaining a much higher rate of demand.

SM: Absolutely that is the only way in which the growth can be sustained. Even if one is focusing on growth, one can’t really get that on a sustained basis unless you have these...

PP: Forget about the kind of growth which is equitable even growth cannot be maintained. Coming back to the other issue that in terms of resources – resources that the government seems to tap is the FDI and the other is sale of public sector shares. Do you think it’s going to make big difference to the economy in terms of external resources?

SM: Well I don’t think the Indian economy at this point is constrained of savings. Even the saving rates have fallen in the last few years pretty significantly but that’s because you have not been able to utilize the productive capacity. So you are not producing what you can produce, not generating the income that you could generate and therefore the savings is low. It’s not that savings is low therefore you have a problem and we are not in any case as an economy getting any foreign resources of a long term nature. So as far as that is concerned I don’t see that provides any kind of a solution to our fundamental problem. At the moment I think the investment processes have been derailed in India not because of resource constraints but because of demand constraints. Emanating from the fact that the distribution of benefits is so narrow. You have kept so many people out of the market and therefore the investment process is not able to sustain itself.

PP: Therefore it goes to the speculative channel rather into manufacturing channel.

SM: Or it will go out if you allow it to go out which is also being permitted so it goes out to an extent, but largely the problem is not one of resources, that you will get the foreign resources and that will solve the problem, that’s unreasonable expectation.

PP: How does it help the Indian economy or the Indian nation to have a 200crores statue? 200crores is actually a small amount, it’s going to be somewhere around 1200 crore finally that we be spend. Aren’t this for the country which is looking at developmental constraints of budget of different kinds, not able to finance public health, public education. Don’t you think this is completely wasteful investment?

SM: Well if it was 200crores expenditure that was an addition to the total expenditure, no matter what its worth of this specific expenditure through some multiplier effects, one could say it could still have some positive effect but this is 200crore expenditure in a time of expenditure compression so it is to come at the expense of something. So it makes it even worse.

PP: Last question, there are about 8 to 10 schemes which have all got 100crores each. Does the number hundred look like a magic wand, for everything 100crores? I can name 10 of them in the budget.

SM: That was one aspect of the continuity that many people noted – announcing various schemes to satisfy various segments but actually allocating very small amounts for them. That’s one of the continuities between the old and the new regimes and many of them are pilot projects and notional things. 100 crores is not a very substantial amount and to highlight so many of these things in a budget speech perhaps was an indication of what was being sought to be hidden. It was more an exercise in hiding than exercise in revealing.

PP: Or what Swami Iyer said the saffron lipstick, if you will.

SM: Well, they have been hiding in the past also, that process continues.

PP: What you are saying is it’s not just lipstick but other cosmetic exercise which has been done.

Thank you Surajit, we will discuss the economy with you as we have been doing in the past and keeping a watch on what’s happening.

Thank you.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.