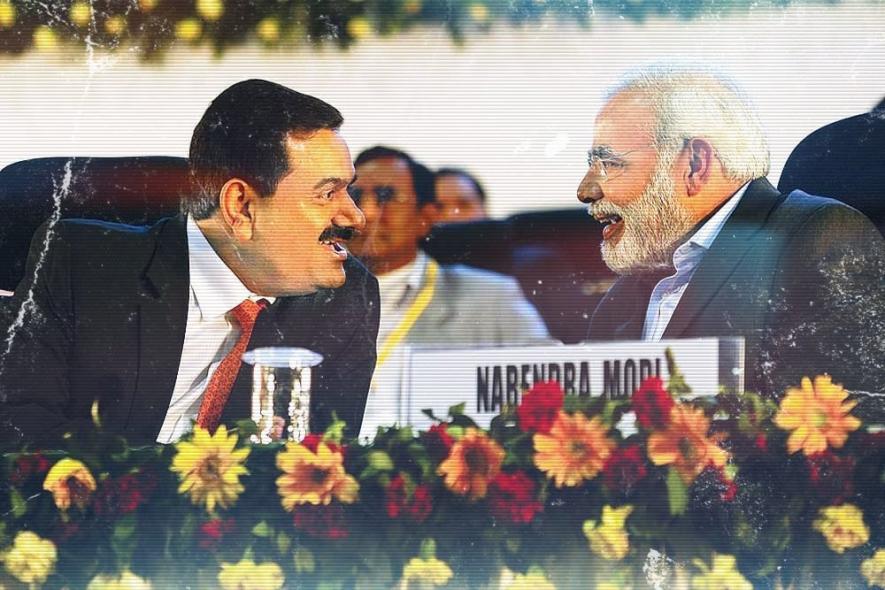

How Modi Bypassed Norms to Try and Enable Adani’s Entry into Airport Business

Picture Credit: Wire.in

On February 25, the Airports Authority of India (AAI) announced that the corporate group led by Gautam Adani had won the bids to upgrade and operate five airports in Ahmedabad, Jaipur, Thiruvananthapuram, Lucknow and Mangalore. The following day, the Adani group won the rights to develop a sixth airport, Guwahati, but the news was overshadowed by the Indian Air Force’s strikes against so-called terror camps in Pakistan.

In the days following the announcement, many objections were raised. The Communist Party of India (Marxist)-headed Left Democratic Front government in Kerala has gone to court. The Union Ministry of Civil Aviation has conceded in the Rajya Sabha, the upper house of Parliament, that the “prescribed procedure (of) public consultation or consultation with the state governments (which) are mandatory for leasing out AAI airports through (the) PPP (Public Private Partnership) mode” were not adhered to.

At the time of writing on March 27, the clearance of the Union Cabinet, which is necessary for the transfer of the airports from the AAI to the Adani group, is yet to come through – and this appears unlikely given the fact that the Model Code of Conduct is in force in the run-up to the forthcoming Lok Sabha elections.

According to documents accessed by Newsclick (see attachment at the bottom), the Modi government violated various laws and procedures while arriving at its decision to privatise the six airports that are currently owned and operated by the AAI. In addition, the recommendations made by the Department of Economic Affairs (DEA) in the Ministry of Finance and the NITI (National Institution for Transforming India) Aayog on the technical, financial and legal aspects of the bidding process were ignored. Instead, conditions were set up that apparently favoured the Adani group.

In this article, we detail how the proposal to privatise the six airports was conceived and pushed through in a tearing hurry, in contravention of the law and existing procedures.

The Background

The AAI was constituted by an Act of Parliament in April 1995, by merging the erstwhile National Airports Authority of India and the International Airports Authority of India. According to the AAI’s website, its responsibilities include “creating, upgrading, maintaining and managing civil aviation infrastructure both on the ground and air space in the country.” The website announces that the AAI manages 18 international airports, seven Customs airports, 78 domestic airports and 26 civil enclaves at defence airfields across the country. In 2017-18, the AAI earned a profit of Rs 2,801.6 crore and held Rs 14,201.1 crore as reserves.

Airport privatisation started in India in September 2003 when the National Democratic Alliance (NDA) government with Atal Bihari Vajpayee as the prime minister approved a proposal to upgrade the country’s two largest airports, at Delhi and Mumbai, in the public-private-partnership (PPP) mode. The government decided at that time that the private partner would be selected through an open and transparent competitive bidding process, and that the winning company would hold 74% stake in the joint venture (JV) company (with the AAI holding the remaining 26%) that would be responsible for executing the upgradation and development programme for the two airports.

Subsequently, new greenfield airports were developed at Bengaluru and Hyderabad by private players. Towards the fag end of its tenure, the Manmohan Singh-led United Progressive Alliance government had considered privatisation of airports in Chennai, Kolkata, Ahmedabad, Lucknow and Jaipur, but the proposal never came to fruition.

Also read: 10,000 AAI Employees to Go on Indefinite Strike Against Privatisation of Airports

After the Modi government came to power, the proposal was taken up again. The AAI invited bids to upgrade these airports in the PPP mode in December 2014. At that juncture, the AAI’s employees’ unions vehemently opposed the move pointing out that the government had already invested a massive Rs 2,300 crore in modernising the Chennai and Kolkata airports in recent years. The unions also pointed out that each of the airports proposed for privatisation had either added new facilities or were being refurbished at that time at the expense of the exchequer. Thus, it was argued that “handing over” the airports to private firms for development would imply bestowing undue favours on particular private companies.

It was reported in the Economic Times in April 2018 that the Prime Minister’s Office (PMO) had “directed” the DEA in the Ministry of Finance and NITI Aayog to prepare a model mechanism for removing certain airports out of the control of the AAI and handing these over to private players. The report quoted an official familiar with the development claiming: “The new model concession agreement would take into account all eventualities, including real-estate development on airport land.”

This was the first indication that despite the objections of AAI employees, the Modi government was adamant about going ahead with the airport privatisation plan. Further, the Economic Times report made clear that despite the existence of the Ministry of Civil Aviation (MoCA), the initiative was being led by the PMO.

In the monsoon session of Parliament, the Modi government tried to amend the Airports Economic Regulatory Authority of India Act, 2008 (AERA Act, 2008). The AERA is a regulatory body, set up in 2008, that is intended to provide a level playing field among different categories of airports in the country. An analysis by PRS Legislative Research explains the objectives of the AERA in simple terms:

“Over the last few years, private players have started operating civilian airports. These private airports run the risk of becoming a monopoly. This is because cities typically have one civilian airport which controls all aeronautical services in that area. To ensure that private airport operators do not misuse their monopoly, the need for an independent tariff regulator in the airport sector was felt. Consequently, the Airports Economic Regulatory Authority of India (AERA) Act of 2008 was passed and the authority was set up.”

“AERA regulates tariffs and other charges (development fee and passenger service fee) for aeronautical services (air traffic management, landing and parking of aircraft, ground handling services) at major airports. Major airports include civilian airports with annual traffic above 15 lakh (15,00,000) passengers. In 2017-18, there were 31 such airports. As of July 2018, 24 of these were being regulated by AERA. For the remaining airports, tariffs are determined by AAI.”

The bill introduced by the government wanted to completely change the way tariffs were determined. The bill proposed that the AERA would no longer determine tariffs, tariff structures and airport development fees, in cases where these were a part of bid documents on the basis of which private players would be awarded rights to oversee airport operations. Hence, the amendment (if it had gone through) would have weakened the authority of the AERA and enabled private firms to exercise monopoly control over charges that are levied at airports.

In addition, the amendment had sought to redefine a “major airport” by more than doubling the minimum required passenger volume for such a classification from 15 lakh to 35 lakh passengers annually. If the bill had been passed and become law, the AERA would have been left with only 14 airports to regulate.

The government failed to pass the bill in both the monsoon session and the winter session of Parliament. It was reported that the government had considered promulgating an ordinance, but this did not happen. With the bill still pending in Parliament, the government invited bids for upgradation of the six airports on December 14, 2018. In apparent violation of the extant law and without changing the AERA Act, private bidders were invited to declare tariffs and passenger charges on the basis of which their bids would be evaluated thereby circumventing the regulatory authority’s powers to determine such charges.

As we shall now see, this decision was taken extremely expeditiously without considering caveats and checks suggested by the NITI Aayog and the DEA in the Ministry of Finance.

The Decision

On November 8, 2018, a meeting of the Union Cabinet chaired by Prime Minister Narendra Modi gave its “in-principle” approval to a proposal by the PMO to lease six airports for development in the PPP mode. An Empowered Group of Secretaries (EGoS) headed by the Chief Executive Officer of the NITI Aayog Amitabh Kant was constituted at the meeting to oversee what is essentially a process of privatisation. Other members in the EGoS included the Secretaries to the Ministry of Civil Aviation, the DEA and the Department of Expenditure (the last two in the Ministry of Finance). The Cabinet noted that its decision would confer the following benefits:

“PPP in infrastructure projects brings efficiency in service delivery, expertise, enterprise and professionalism apart from harnessing the needed investments in the public sector.The PPP in airport infrastructure projects has brought world class infrastructure at airports, delivery of efficient and timely services to … airport passengers, augmenting (the) revenue stream (of) the Airports Authority of India without making any investment, etc… for (the) development of greenfield airports at Hyderabad and Bengaluru. Presently, the airports being managed under the PPP model include Delhi, Mumbai, Bangalore, Hyderabad and Cochin.”

“The PPP airports in India have been ranked among the top five in their respective categories by the Airports Council International (ACI) in terms of Airport Service Quality (ASQ). While these PPP experiments have helped create world class airports, it has also helped AAI in enhancing its revenues and focusing on developing airports and (the) air navigation infrastructure in the rest of the country.”

From here onwards, the decision-making process moved ahead at a lightning speed. The EGoS met on November 17 and submitted its report on December 4, less than a month after the approval of the Cabinet. Six days later, on December 10, appraisal notes prepared by the NITI Aayog and the DEA were forwarded to the NITI Aayog CEO, the Secretaries to the Department of Expenditure in the Finance Ministry and the Department of Legal Affairs in the Ministry of Law and Justice, together with the AAI Chairman, informing them that the Public Private Partnerships Appraisal Committee (PPPAC) – the committee that has to clear all PPP projects undertaken by the Union government – was scheduled to meet the very next day, that is, on December 11, to discuss the proposal relating to the effective privatisation of six airports managed by the AAI.

In its appraisal note, the DEA raised several issues. It stated that neither the AAI nor the MoCA had submitted details of the break-up of project costs to the PPPAC for its consideration. Neither had they provided KPIs or key performance indicators, development plans or details of capital works in progress that had been undertaken by the AAI and which the new concessionaire would be required to complete. It was pointed out that without these details comparing technical proposals submitted by bidders would be very difficult.

Also read: PM’s Rapid-Fire Announcements: Job Creation or Corporate Handouts?

Further, the note said the MoCA had not submitted the “deviation statement from the documents followed for the preparation of the bid documents” – namely the Request for Quotations (RFQ), the Request for Proposals (RFP) and the Draft Concession Agreement (DCA). In addition, what was required to be submitted was a legal vetting certificate and detailed calculations to support the figures stated in the memorandum to the PPPAC together with the project report. This was considered especially important because the numbers to determine financial viability mentioned in the PPPAC memo and the project report were “vastly different”.

The PPP cell of the DEA recommended that since these six airport development projects are “highly capital intensive,” a clause should be incorporated that not more than two airports would be awarded to a single bidder because of the high financial risks involved and the need for stringent adherence to performance indicators.

Awarding the airport development projects to different companies would also facilitate comparisons using defined yardsticks and that there was greater competition, the DEA note suggested, adding that in case there was a “project failure,” there would be other capable bidders available to take on the failed projects. The DEA recalled that when private companies bid for the development of the airports in Delhi and Mumbai airports, although the GMR group was the only “qualified bidder,” the contracts to develop both the airports were not given to the same bidder. The department also cited the example of privatisation of the power distribution network in Delhi wherein contracts were given to more than one bidder.

These suggestions were completely forgotten subsequently. Was this done for the benefit of one player, the Adani group, which emerged as the winner in the bids to develop six airports?

Financial Parameters

The story does not end here. The DEA asked the AAI and the MoCA to submit examples of proposed transaction structures (based on a fee per passenger) that were followed by airports in different countries and the benefits such structures had over a revenue-sharing model. The department in the Finance Ministry also wanted the technical capacity and the financial capacity of the bidder to be linked with the project cost. Hence, it recommended that the worth of the bidder’s technical capacity must be twice the total project cost (TPC) while the bidder’s financial capacity measured in terms of its net worth should be a fourth of the TPC.

As for the concession period of 50 years, it was recommended that “the detailed project financials with all assumptions including (the) financial model to support the 50 years concession period needs to be submitted.” The DEA added: “It is … suggested that the concession period should be co-terminus with all the project facilities including city-side development facilities. Further, it is suggested that after efflux of concession period, all assets should be returned to the (Airports) Authority free of cost.”

Moreover, the department stated that a license model be followed instead of a lease model. It was recommended that the bidders submit “all the details such as project scoping, project sizing, demand supply analysis to ascertain the (financing) gap, periodic capital investment, regulatory framework with regard to (the ) AERA and (the) National Civil Aviation Policy (of) 2016, (the) demand-supply analysis to justify the projected revenues and the financial returns and component-wise break-up of project cost with assumption(s)/benchmarks”.

The NITI Aayog, in its assessment made on December 10, agreed with many of the suggestions made by the DEA. It said:

“While it is important to enlarge the spectrum of bidders through the inclusion of players from other sectors, it is also important to ensure that the quality of experience is suitable to the technical capabilities required for undertaking (the) proposed projects. Also it needs to be mentioned that such differentiation of sectors and quality of experience has already been captured under the model RFQ through the classification of experience in the following categories:

(a) project experience in the sector to which (the) proposal pertains;

(b) project experience in other core sectors;

(c) construction experience in the sector to which (the) proposal pertains; and

(d) construction experience in other core sector(s).

Also read: Is the Modi Government Misleading Parliament by Cherry-Picking Data?

The NITI Aayog specifically suggested that the RFP should include criteria to measure the experience of the bidder in developing airport terminals and related sectors. It wanted to change the evaluation parameter for selecting the bidder who quoted the highest “per passenger fee” because the method for calculating such a fee had not been elaborated upon. This is what was stated by the Aayog in a note:

“While the challenges of monitoring and finalising the gross revenue in case of gross revenue share model is valid, (the) challenges with the proposed parameter may also need to be evaluated. It needs to be noted that the actual payment received by the authority in this case shall be determined by the actual passenger volume every month/year. Hence during periods of low passenger volume, the receipts shall be adversely impacted. From the concessionaire’s perspective, on the other hand, the passenger volume shall only impact part of his revenues and in a scenario where the passenger volume for particular periods are low but … other aeronautical revenues are high, the authority shall lose out on the portion of non-passenger related revenues. Under the gross revenue share model, no party can be unilaterally disadvantaged/benefitted because of fluctuation in passenger volume, real estate rates etc. In light of this there may be a case to re-consider the financial bid evaluation parameter.”

None of the recommendations made by either the DEA or the NITI Aayog were included in the bid documents.

This is what the Economic Times reported on November 24 quoting an unnamed government official that indicates the interest of the Prime Minister’s Office in the sector:

“The PMO and NITI Aayog are not happy with the sector’s performance and have registered the displeasure over the (Civil Aviation) ministry’s performance. The committee (meaning the EGoS) is part of their attempt to ensure that plans are implemented and growth continues in the sector.”

The record of discussion of the PPPAC indicates that the following 13 persons particpated in the meeting held on December 11. They were the Secretaries of the DEA and the MoCA, the Additional Secretary, Civil Aviation, the officiating Chairman of the AAI, the Joint Secretary, Infrastructure Policy and Finance Division (IPF) of the DEA, the Advisor, NITI Aayog, the Director (PPP) in the DEA, the directors in the MoCA and the Department of Expenditure in the Finance Ministry, the Deputy Director (PPP) and the Assistant Director (PPP) in the DEA, the Executive Director of the AAI and the Deputy Legal Advisor, Department of Legal Affairs.

The guidelines of the PPPAC stipulate that in the case of central sector PPP projects, the committee should consider a proposal for “in-principle” approval within three weeks of the date of submission of the proposal by the administrative ministry. Three more weeks after submission of the final documents by the administrative ministry are given for final approval of the proposal. But in the minutes of the meeting of the PPPAC, it has been noted that this was a “special case,” and hence, the committee “agreed to consider the proposal in the limited time considering the nature of (the) project, (the) tight time table which (the) Ministry of Civil Aviation is pursuing in this case and as decided in the meeting of (the) Empowered Group of Secretaries (or EgoS).” In the next sentence, the minutes clarified almost as an afterthought: “However, the quality and rigour of the examination was not at all compromised.”

Also read: EXCLUSIVE: French Order for 28 Rafale Gives Away What Modi Wants to Hide

The project report, the PPPAC memorandum, the draft RFP and the DCA were shared by the Secretary, MoCA with those who participated in the meeting for “in-principle” and “final approval” on December 6. The Joint Secretary (IPF), DEA, Dr Kumar V Pratap pointed out the time-frame mentioned in the PPPAC policy guidelines for approval for such projects. It is not known if he raised questions about how someone could peruse and study the voluminous project reports of six different airports and the terms and conditions contained in the detailed bid documents (the RFP) in barely a few hours to accord approval for leasing out government assets worth thousands of crores of rupees.

The committee decided to “consider the proposal for in-principle and final approvals” on the same day because it was pointed out that after the PPPAC’s appraisal, as per the Department of Expenditure’s guidelines for approval of projects worth more than Rs 1,000 crore, the competent final approving authority would be the Cabinet Committee on Economic Affairs (CCEF). As already stated, the clearance of the Cabinet is necessary for the transfer of the airports from the AAI to the Adani group and this is unlikely to come through since the Model Code of Conduct is applicable before the general elections, the results of which will be known on May 23.

Changing Eligibility Criteria

Be that as it may, what the PPPAC decided is nevertheless significant in understanding how the rules were tweaked ostensibly in favour of a particular business conglomerate headed by a person (Gautam Adani) perceived to be close to Prime Minister Modi.

The PPPAC decided not to discuss issues already considered by the EGoS in its two meetings before submitting its report. The bid document (or the RFP) laid down the technical eligibility criteria for evaluating the bidder which included demonstrating technical capacity and experience over the past seven financial years preceding the bid date, and payments made or received for construction or development of “eligible projects” equal to or more than Rs 3,500 crore for one project, half the amount for two projects and 40% for three projects. The list of eligible projects were specified in the DEA’s Harmonized Master List of Infrastructure Sub-sectors that covers a vast number of projects including soil testing laboratories.

It is important to highlight here that this particular decision on eligibility criteria for the bidders was taken by the EoGS in its very first meeting held on November 17.

More significant was the PPPAC agreeing to go along with the decision of the EGoS that “prior airport experience may neither be made pre-requisite for bidding, nor a post-bid requirement.” The reason the EGoS cited for such a decision was “to enlarge the competition for already operational brown-field airports”. The PPPAC readily agreed with what the EGoS decided and this paved the way for the Adani group, which has no prior experience of developing or operating airports, to become eligible for bidding.

While deliberating on the financial eligibility criteria, the PPPAC once again went along with what the EGoS decided: “No restriction (should) … be placed on the number of airports to be bid for or to be awarded to a single entity.”

It was further decided that the criteria for bidding for the development of all six airports would be a uniform one irrespective of actual and projected passenger volumes. The Joint Secretary (IPF) in the DEA suggested that the TPC (total project cost) must be calculated upfront in order to frame the eligibility criteria in terms of technical and financial capacity and other financial covenants like bid security, performance security and so on.

The Secretary, MoCA, said that it would not be possible to calculate the TPC in advance for a proposed lease period of 50 years. Till this time, there had not been any recorded official mention anywhere that the lease tenure would be 50 years because all similar contracts in the past specified a tenure of 30 years. Who proposed this change in the lease tenure and who approved it, is far from clear from the documents examined by the writer of this article.

The PPPAC meeting also decided that there would be no cap on the amount of land on the “city side” adjoining the airport that could be developed for commercial use by the concessionaire. This was contrary to the suggestion made by the Joint Secretary (IPF) in the DEA in the Finance Ministry who argued for a cap of 5% on the area that could be developed leaving the rest of the land for the airport’s development.

This civil servant Dr Kumar V Pratap, who studied at the Indian Institute of Management, Lucknow, and holds a doctorate in privatisation of infrastructure from the University of Maryland in the US, seems to have cut a lonely figure as a contrarian at the meeting of the PPPAC.

He also suggested that after the concession period got over, the concessionaire should return all assets to the AAI free of cost. However, a majority of participants at the meeting of the committee decided that while all “aeronautical assets” should be returned free of cost, the AAI would have to pay 50% of the value of the “city side development done by the concessionaire in the first 30 years”.

It appears indeed rather strange that this group of civil servants should decide that the depreciated value would be 50% in the case of buildings two decades after they have been constructed, and that too after the concessionaire has recovered expenses by charging users over the entire concession period of half a century! This is akin to a double whammy benefit or a sweetheart deal for anyone who is privileged to bag such a contract.

During the monsoon session of Parliament, on July 26, 2018, the Union Minister of State for Civil Aviation Jayant Sinha replied to a question on the government’s plans to privatise airport operations in the country. His reply read: “At present, there is no proposal with (the) AAI to develop and modernize any airport across the country under (a) Private Public Partnership.”

This indicated that the MoCA had no clue about what the PMO had asked NITI Aayog and the DEA to do a few months earlier in April, if the report published by the Economic Times is to be believed.

Also read: Did Modi Unilaterally Also Fix Rafale Price in April 2015?

Less than a fortnight after replying to this question in Parliament, on August 9, Sinha submitted a list of AAI-operated airports and their revenues and profits. What was clear from the data provided is that the six airports that are being sought to be effectively privatised – namely, Ahmedabad in Gujarat, Guwahati in Assam, Jaipur in Rajasthan, Lucknow in Uttar Pradesh, Mangaluru in Karnataka and Thiruvananthapuram in Kerala – were among the highest revenue earners and generators of profit among all the airports operated by the AAI.

All these six airports had been renovated using public money over the past few years. For example, the new terminal at Lucknow had been inaugurated in 2012, while the revamp of the airports in Ahmedabad and Thiruvananthapuram had been completed two years earlier in 2010. The documents submitted by the AAI to the PPPAC said the public sector corporation had already spent Rs 782.3 crore (out of a total project cost of an estimated Rs 1,472.7 crore) for the development of the Jaipur airport. The comparable figures for Lucknow were Rs 583 crore (out of Rs 1,090.4 crore), Rs 384.4 crore (out of Rs 1,320 crore) for Ahmedabad airport, Rs 363 crore (out of Rs 118.9 crore) for Mangaluru airport and Rs 400.5 crore (out of the Rs 413 crore) for Thiruvananthapuram airport. In the case of Guwahati airport, the estimated project cost was Rs 684.4 crore, but the AAI already invested Rs 823.7 crore in that airport.

Having already invested substantial sums of public money through the AAI, how did it make sense to hand over the development and operation of these airports to a private firm?

The government was clearly in a huge hurry. So was the AAI. As already mentioned, the RFP was floated on December 14 without including any suggestions and recommendations made by the Finance Ministry and the NITI Aayog, the third day after the meeting of the PPPAC. Two months later, the deal was sought to be clinched. For interested bidders, all formalities – such as access to the data room, sending questions to the AAI, a pre-bid conference, receiving the AAI’s replies to queries, and sale of bid documents – had to be completed before February 14.

Even before the approval of the PPPAC, the New Indian Express reported on January 8 that the Kerala state government’s efforts to bid for the development and modernisation of the Thiruvananthapuram airport might not go down well with the Union government and the AAI because the Adani group was already perceived to be the front runner for winning the bids for developing the airport.

A week before the last date of submission of bids, that is, on February 6, the Hindu Business Line published an article titled “Airports privatisation: Eligibility norms for bidders stokes fears of foul play.” The article quoted different industry experts citing “anomalies” in the eligibility terms for bidders and the “tight timeline for award of projects”. The article argued that the move to privatise six non-metro airports run by the AAI would potentially “eliminate competition” and favour a “chosen few.” It quoted an unnamed executive of a firm which was participating in the bidding process saying: “The timeline for the entire bidding process is extremely short given the importance of the projects requiring detailed due diligence and analysis of techno-commercial, legal, contractual and regulatory complexities.”

Another anonymous expert was quoted stating:

“As per the established norms, technical capacity is experience in projects worth double the estimated project cost. The eligibility criteria should, therefore, have been linked to the project cost and should have been different for each airport project. However, the RFP documents require the same experience for all the six airport projects irrespective of the size of the airport project/cost.”

This was exactly the recommendation of the DEA which was not accepted by the AAI and by the MoCA.

The Hindu Business Line article added:

“The RFP documents mandate the successful bidder to pay a certain upfront amount towards cost of works currently incurred by AAI. It is, however, not clear whether the cost of works currently incurred by AAI is against the capital expenditure projected and that the successful private operator is expected to incur only the balance of projected capital expenditure.”

The article concluded by quoting another industry expert saying:

“The errors in the RFP documents and the tearing hurry to complete the bidding process and award of projects appears to be aimed at allowing only a chosen few to make to the shortlisting and prevent wider competitive participation by other serious potential bidders.”

On February 16, two days after the last date of submission of bids, the technical bids were opened. There were 32 players who had bid for the development of all the six airports. Nine days later, on February 25, the financial bids for five airports (with the exception of Guwahati) were opened at 11 am. The same afternoon, the AAI put out a press release mentioning the “per passenger fee” quoted by all the participants based on which the Adani group emerged as the highest bidder. The next day, the financial bid for Guwahati airport was opened and once again, the Adani group came out on top.

The state government of Kerala had earlier proposed to the AAI that it hand over Thiruvananthapuram airport to it for development on a revenue sharing basis. The airport in the capital city of the state (which attracts many tourists as well as domestic passengers) is situated on a large plot of land totalling 636.57 hectares. The AAI owns only 0.05756 hectares and the rest is owned by the state government. The MoCA and the Union government rejected this proposal and asked the Kerala government to participate in the bidding process to develop the airport together with private players. The state government later filed a petition in the Supreme Court citing the anomalous manner in which one private corporate group won bids to develop six airports.

On March 9, the Times of India published a report claiming that the Ministry of Civil Aviation has conceded that “…as per the prescribed procedure, public consultation or consultation with the state governments are mandatory for leasing out AAI owned airports in PPP model” and that this was not done in the case of these six airports.

Time alone will tell whether the government of Prime Minister Narendra Modi will be able to oversee the handing over of the development of the six airports to the corporate group headed by Gautam Adani.

Ministry of Finance, Department of Economic Affairs, PPP Cell, F no 2/5/2018-PPP by Newsclick on Scribd

(Edited by Paranjoy Guha Thakurta and Abir Dasgupta.)

Also read: Rafale: Do French Senate Documents Nail Modi’s Lie?

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.